Generated Title: Stripe's Crypto Gambit: Can Tempo Actually Hit 100,000 TPS?

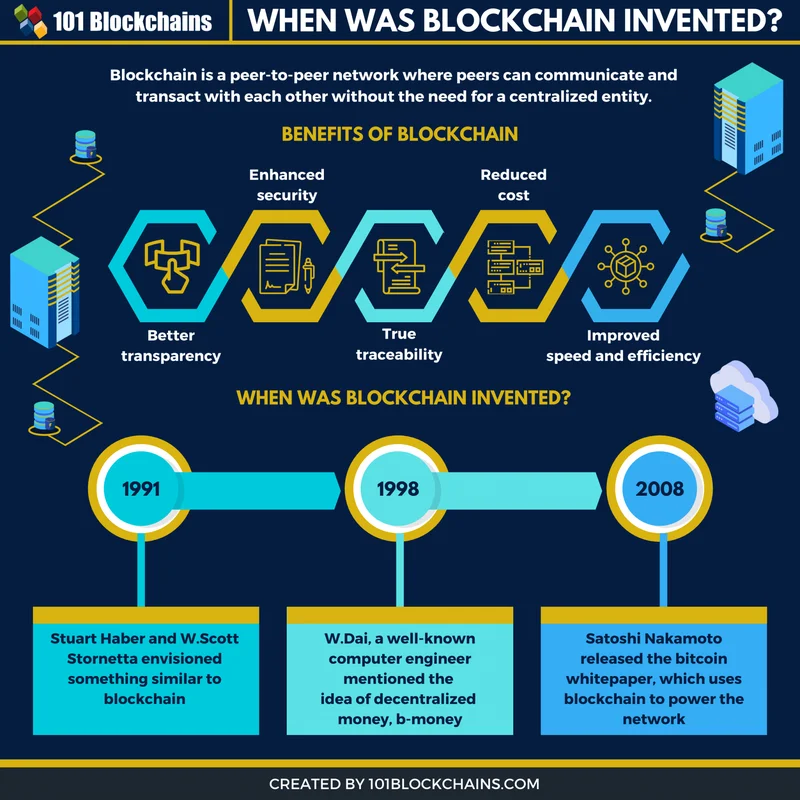

Stripe, not content with merely processing payments, is apparently building a new layer-1 blockchain called Tempo, designed specifically for stablecoins. The headline figure? A claimed 100,000 transactions per second (TPS). That's the kind of number that makes crypto enthusiasts—and skeptics—sit up and take notice.

Decoding the Tempo Promise

Let's break this down. Tempo, incubated by Paradigm and Stripe, aims to be an EVM-compatible chain focused on payments. The stated goal is to facilitate everything from global payouts to microtransactions, all fueled by stablecoins. They've even snagged Ethereum dev Dankrad Feist, which is a clear signal of intent. The $500 million Series A valuing the project at $5 billion is significant (and, frankly, eyebrow-raising for a project still in private testnet).

The core selling point, of course, is that 100,000 TPS figure. Compare that to Ethereum's current 21.8 TPS or even Solana's 1,344 TPS, according to their respective block explorers. It's an order of magnitude faster. But here's where the skepticism kicks in: how are they achieving this?

Tempo highlights features like batch transfers and memo fields. They also tout an automated market maker (AMM) that lets users pay gas fees in any stablecoin. Plus, there's opt-in privacy. All interesting, but none of these inherently explain the massive TPS leap.

The article mentions Tempo is currently using a set of independent validators, some run by early design partners. This is crucial. A permissioned network, where only trusted parties validate transactions, can achieve higher TPS. But it comes at the cost of decentralization. The question is: will Tempo's TPS hold up when they transition to an open, permissionless network?

The Decentralization vs. Speed Tradeoff

This is a classic blockchain trilemma: security, scalability, and decentralization. You can usually only optimize for two. Tempo seems to be prioritizing scalability (speed) and security (through trusted partners, initially), potentially at the expense of true decentralization, at least in the short term.

And this is the part of the report that I find genuinely puzzling. The article emphasizes the eventual goal of a permissionless network. But how do they plan to maintain 100,000 TPS in a truly open environment? What consensus mechanism will they use? What are the hardware requirements for validators? These details are conspicuously absent.

It's also worth considering the competitive landscape. While stablecoins have surged to a $300 billion market cap (according to DeFi Llama), the space is becoming increasingly crowded. Existing chains are also working on scaling solutions. Will Tempo's first-mover advantage (if it can truly deliver on its promises) be enough to carve out a significant market share?

Tempo also boasts "opt-in privacy." That's a clever marketing angle, given the regulatory scrutiny surrounding stablecoins. But "opt-in" also means it's not inherently private like, say, Monero. How will Tempo balance privacy with compliance, especially as regulations tighten?

The Devil is in the Latency

The 100,000 TPS claim is like a flashy sports car ad. Sure, it can go that fast, but only under ideal conditions, on a closed track. In the real world, traffic, road conditions, and speed limits come into play. In the blockchain world, the equivalent is network latency, consensus mechanisms, and transaction complexity.

Even if Tempo can process 100,000 simple stablecoin transfers per second, what happens when you add smart contract logic or complex multi-party transactions? The TPS will inevitably drop. What's the sustained TPS under real-world conditions? That's the number I'm really interested in.

The involvement of major players like OpenAI, Shopify, and Visa lends credibility. But it also raises questions. Are these companies genuinely committed to building on Tempo, or are they simply exploring the technology? Are they willing to stake their reputations on a blockchain that's still in its infancy?

So, What's the Catch?

The lack of technical details surrounding Tempo's scaling solution is concerning. The 100,000 TPS figure is a tantalizing headline, but without a clear explanation of how it's achieved—and how it will be maintained in a permissionless environment—it's just marketing hype. Stripe has a track record of innovation, but even they can't defy the laws of physics (or blockchain consensus). I'll believe the 100,000 TPS when I see the data.