Anthropic's European Expansion: Impressive Growth or Inflated Claims?

Anthropic Goes Continental: A Data Dive

Anthropic, riding the AI hype train, is planting flags across Europe, with new offices in Paris and Munich. The press release is predictably bullish: EMEA revenue up 9x, large business accounts up 10x. But let's pump the brakes for a minute and look at what this really means. (Because, let's be honest, press releases are marketing documents, not sacred texts).

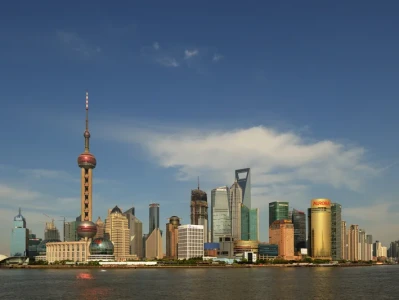

First, the 9x revenue growth. Impressive? Sure. But from what baseline? If you start with a tiny number, even modest gains look huge percentage-wise. Was it $1 million to $9 million? Or $10 million to $90 million? The difference matters. Details on the starting point are conveniently absent. New offices in Paris and Munich expand Anthropic’s European presence

And then there's the "large business accounts" metric – those billing over $100,000 annually. A 10x increase sounds great, but again, it's all about the starting point. Were there five clients last year? Fifty? Until we get real numbers, this looks more like smoke and mirrors. (A tactic I saw way too often back in my hedge fund days, I might add.)

Anthropic’s Chris Ciauri talks about European business leaders being "clear-eyed" about AI's potential and the importance of safety. A nice sentiment, but how is Anthropic quantifying that "clear-eyed" understanding? Are they running surveys? Measuring adoption rates of safety features? Or is this just feel-good rhetoric?

The German-French Connection: A Calculated Risk?

The choice of Germany and France as hubs makes sense on the surface. They're large economies, rank high in Claude usage per capita, and boast global giants in key sectors. But "high Claude usage per capita" is another slippery metric. Is it driven by a small number of power users, or broad adoption across various industries? (I've looked at similar "per capita" metrics in emerging markets, and they can be wildly misleading.)

The article mentions enterprises like L'Oréal, BMW, SAP, and Sanofi using Claude. These are established players. But what about the startups mentioned – Lovable, N26, Pigment, Qonto, and Doctolib? What percentage of their operations actually rely on Anthropic's technology? And what's their churn rate? Are they sticking around, or just kicking the tires?

Anthropic is also partnering with educational and cultural organizations, like Light Art Space (LAS) in Berlin and TUM.ai in Munich. This is a smart move for optics and talent acquisition. But does sponsoring a hackathon really translate into long-term market penetration? (I'm skeptical.)

Then there’s the leadership team they’re assembling. Guillaume Princen will head up startups, Pip White will lead EMEA North, and Thomas Remy will oversee EMEA South. They’re also going to announce a new Head of DACH & CEE. All impressive resumes from Google, Salesforce, and the like. But here's the thing: can these execs actually deliver concrete results? Or are they just along for the AI gravy train? The success of this expansion hinges on their execution, not just their LinkedIn profiles.

It's interesting to compare this expansion to the situation in Ukraine. Rasmussen, the former NATO chief, argues that Europe needs to step up pressure on Russia to avoid a "forever war." He suggests deploying troops and establishing a missile shield. In a way, Anthropic's European expansion is a similar gamble – a bet that the region will embrace AI wholeheartedly and that Anthropic can secure a dominant position before competitors catch up. The difference, of course, is that the stakes are far lower. Ukraine faces ‘forever war’ unless Europe steps up pressure on Russia, says ex-Nato chief

The Hype Doesn't Match the Hard Numbers

Anthropic's European expansion could be a game-changer. But until they release some real, verifiable data, I'm filing this under "cautiously optimistic." The press release reads like a carefully crafted narrative designed to impress investors, not inform the public. And as someone who spent years dissecting corporate spin, I'm not buying it – not yet, anyway.